The tax reform law has had one interesting consequence for the retirement industry: It has driven up interest in different types of savings plans that work in tandem with 401(k) plans to help company owners and highly compensated employees set more money aside for retirement. Mike Weintraub, president of Relation Insurance Services’ retirement division, says […]

michael@franchisebenefitsusa.com

Posts by 'michael@franchisebenefitsusa.com'

Though some might think that reduced physical demands at work would improve employee health — that more comfortable, sedentary jobs would be safer and healthier long-term — more and more research show that the opposite is true. Even with reduced heavy labor, increased automation and more advanced medical therapies, our nation continues to see a […]

Are only the largest retirement plans audited? The truth is that plans of any size can be audited by the IRS and the DOL. Your plan could be selected for a random audit, or as a result of IRS datasets that target certain types of plans. However, lots of audits are triggered by specific events. […]

Saddled with about $30,000 of student loan debt and lower wages than their parents were making at their age, millennials and Gen Z are forgoing traditional saving strategies to tackle existing debt. The changing workforce demographic has created a new protocol for HR departments to follow, which includes updating the benefits package to resonate with younger employees. […]

KANSAS City, Mo. — The cost of prescription drugs continues to be a major concern among health plan sponsors and members alike. With no signs of falling in the near future, experts are attempting to understand where the increases began and what options are available today. During the National Association of Health Underwriter’s Annual Convention […]

With more than half of U.S. workers leaving their current job in search of better pay and benefits, a compelling benefits package is a critical competitive advantage for small businesses. It allows them to stand apart from companies of similar sizes and better stack up against larger ones when competing for candidates or attempting to retain talented […]

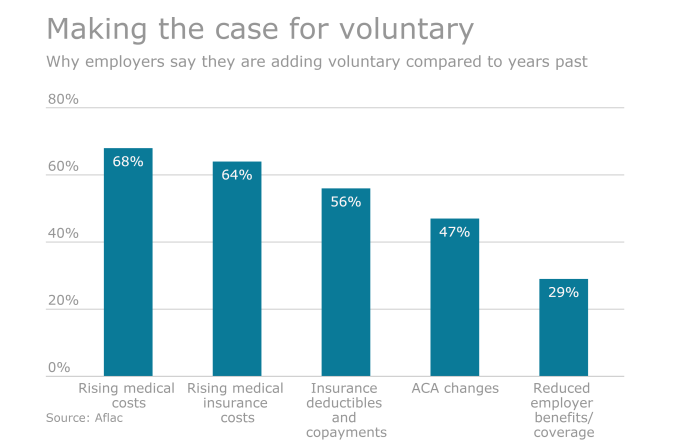

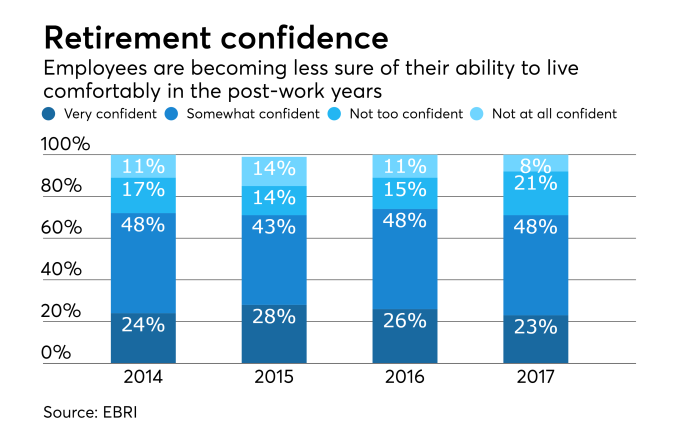

Whether your employees are 22 or 62, they need to plan for the unexpected. A sudden injury or illness can dramatically derail their financial well-being and retirement readiness. As the responsibility for healthcare costs shifts to employees, employers are taking steps to help their employees by offering voluntary benefits, like critical illness and accident insurance. […]

When CareHere CEO Ernie Clevenger suggested his company switch to self-funded health insurance, there were more than a few people, including the firm’s chief financial officer, who expressed reservations. Not surprisingly, their main concern was what would happen if the 800 employee Brentwood, Tenn.-based chain of on-site health clinics experienced a catastrophic claim. That hardly […]

Providing for ourselves and loved ones is one of many motivations to get up and go to work — a globally shared sentiment. While that motivation may be what attracts potential applicants to an employer’s door, it won’t be enough to retain employees unless we consider what benefits packages could look like without breaking the […]

Plan sponsors who have written off the defined benefit plan as a relic of the past may want to reconsider. While the number of participants in DB plans has declined somewhat in recent years, the number of DB plans has been rising. Specifically, the number of single-employer DB plans with fewer than 100 participants rose […]