Student loan debt has become a key component of the broader financial wellness conversation, and employers are beginning to realize the value of offering a benefit that will help employees get a handle on the latest U.S. debt crisis. Yet employers are still falling behind on the work that needs to be done as just […]

michael@franchisebenefitsusa.com

Posts by 'michael@franchisebenefitsusa.com'

Low-income employees are at a high risk for facing financial barriers to healthcare, which could mean higher costs and lost productivity for employers down the road. Even when low-income workers — or those with annual family incomes of less than $35,000 — have employer-sponsored insurance, hurdles like high deductibles, coinsurance and drug prices can keep […]

House lawmakers overwhelmingly passed legislation to repeal the Cadillac tax, the Affordable Care Act’s tax on high-cost health plans, 419-6 late Wednesday. H.R. 748, titled the Middle Class Health Benefits Tax Repeal Act, received bipartisan support for killing the excise tax, as industry groups and labor unions have become vocal in its repeal over the […]

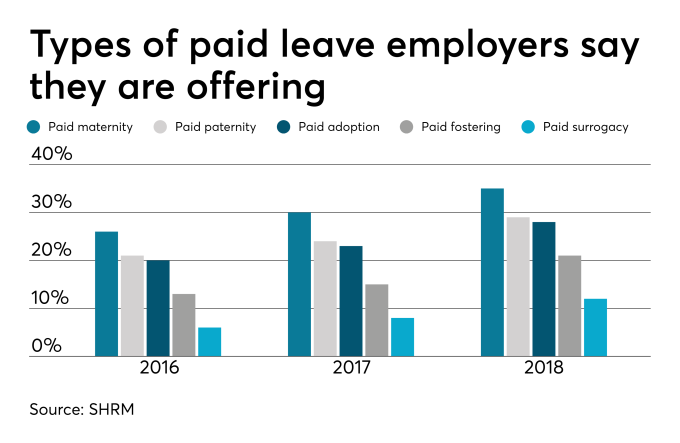

While the U.S. is the only developed country in the world without a federal paid leave policy, more states are passing laws mandating paid time off for workers to care for new or ailing family members. Last week, Oregon became the eighth state to pass such a law when it signed a bill, giving workers 12 […]

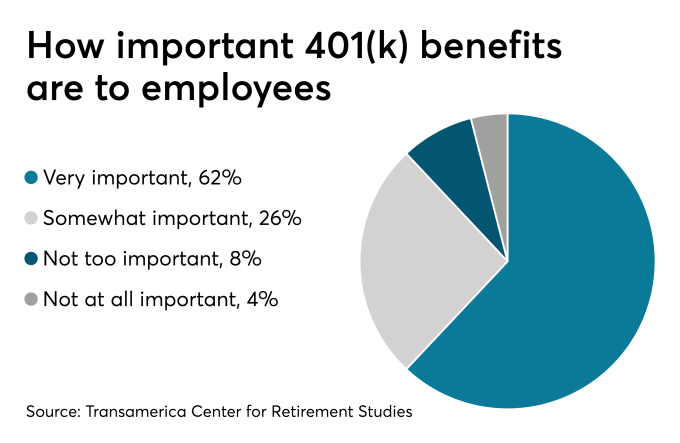

Not offering employees a retirement plan? For workers in California, the state has them covered. The California State Treasurer’s office announced the launch of CalSavers Retirement Savings Program, a state-run IRA, this week. Over 7.5 million California employees without employer-sponsored retirement plans can access the program, making it the largest state-run retirement benefit in the […]

A sales employee suffers from acute stress and anxiety, which ultimately force him to take a 12-week medical leave of absence under the FMLA. Later that year, when the employer considers bonuses, the employee does not receive one because he failed to meet the established sales targets. The employee maintains that the employer’s decision was […]

Helping employees prepare for retirement remains a top concern for leading CHROs and other senior HR professionals, but student loan benefits is “the big one” that most are trying to get right, says Ayco CEO Larry Restieri. Employers such as PwC, Prudential and other companies have been adding the popular benefit to meet demand as […]

LAS VEGAS — Student loan benefit provider Gradifi’s client list has ballooned to more than 750 with new additions of New Balance and Wayfair, the company said Monday. The footwear and e-commerce companies are joining a group that already includes PwC, Sotheby’s, Honeywell and Peloton. The news — announced during the Society for Human Resource Management annual […]

EASTON, Pa. — Walk into a big-box retailer such as Walmart or Michaels and you’re likely to see MCS Industries’ picture frames, decorative mirrors or kitschy wall décor. Adjacent to a dairy farm a few miles west of downtown Easton, MCS is the nation’s largest maker of such household products. But MCS doesn’t actually make […]

The IRS Thursday published finalized rules loosening restrictions on health reimbursement arrangements, allowing employers to significantly expand the use of such accounts and make them a much bigger part of employers’ healthcare offerings. Beginning in January 2020, employers will be able to use individual coverage HRAs to provide employees with pre-tax funds to pay for […]